On the cryptocurrency exchanges, traders and investors can really buy a cryptocurrency. Trading on an exchange grants you ownership of the cryptocurrency and you can transfer it to an address (your own wallet). One of the disadvantages of trading cryptocurrencies through exchanges is that the security of your funds is not as high. Some exchanges are not under direct regulation by any agency and deposits and withdrawals are usually more complicated when compared to most brokers. Keeping your funds on the exchange could be very dangerous. Many exchanges are privately owned by small companies that only exist several years on the market. Most exchanges were not built for the beginners, their customer support is not always available, crypto exchanges have also fallen victim to cyber attacks. Exchanges are usually getting hacked, lots of users have complained about not being able to execute crucial trades on time or withdraw their funds when they want. Clients are not in control of their funds and if something goes wrong it could be a very difficult to recover their funds. There have been many hacks and scams, some of the most famous include: Poloniex, BitStamp, Mt. Gox, BTCe, Shapeshift, Gatecoin, Vircurex.. The way they were hacked were not the same, some lost customer funds while some lost personal information of their clients. In 2014, the largest bitcoin exchange Mt. Gox was bankrupt. Hundreds of millions of dollars of bitcoin were lost and the bitcoin world was devastated. Bithumb was also recently hacked and that resulted in the loss of billions of won from customers accounts, approximately three percent of customers were hacked. The personal information of 31,800 Bithumb users, including their names, mobile phone numbers, and email addresses were infected by the June 2017 hack.

Major cryptocurrency exchanges are relatively secure ways to store your coins but it’s typically not advised for large amounts. When choosing the cryptocurrency exchange, always check history and reviews to make sure their performance and security are consistent. Secure exchanges that are trustworthy and have good user ratings will rank higher than their peers.

My recommendation would be if you plan to hold cryptocurrency for the longer period, don’t keep it in an exchange. The best solution is to get a wallet and don’t leave your coins to somebody else’s hands. With “Cold Storage” you will get the maximum security because your coins will be on a device that is not connected to the internet so it can’t be hacked. Safe cold storage wallets store the user’s private keys in a secure hardware device. These wallets are immune to computer viruses and the private keys cannot be transferred out of the device in plaintext. Safe cold storage wallets can be used securely and interactively allowing a user to validate the entire operation of the device. People sometimes use USB devices or a computer without internet connections so hackers can not find it and will never be able to access it.

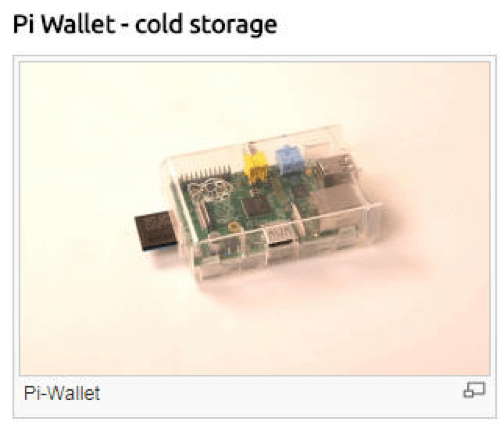

The list of safe cold storage wallets that are popular:

- Pi Wallet – Transactions are signed offline, then transferred on a USB stick via Sneakernet to an online system for broadcasting

- Ledger HW.1 wallet – a blind secure device for multi-signature transactions

- Ledger Unplugged NFC – a credit card sized NFC hardware wallet that is compatible with all NFC enabled Android phones

- TREZOR – a secure bitcoin storage and a transaction signing tool that can hold an unlimited number of keys. The private keys are generated by the device and never leave it thus they cannot be accessed by a malware

- KeepKey USB – every transaction must be reviewed and approved via it’s OLED display and confirmation button

- CoolWallet – this device stores and secures your coins and private keys. Every transaction must be manually confirmed and approved

Conclusion

Keeping your funds on the cryptocurrency exchange could be very dangerous and with hack attack, you can lose all of your funds. One of the disadvantages of trading cryptocurrencies through exchanges is that the security of your funds is not as high. Major cryptocurrency exchanges are relatively secure ways to store your coins but it’s typically not advised for large amounts and for the longer time periods. In last several years, multiple accounts of bitcoin have been stolen via hacking of some of the major exchanges. My recommendation would be if you plan to hold cryptocurrency for the longer period, don’t keep it in an exchange. The best solution is to get a wallet and don’t leave your coins to somebody else’s hands. With “Cold Storage” you will get the maximum security because your coins will be on a device that is not connected to the internet so it can’t be hacked.

What exactly is Bitcoin?

Bitcoin is basically a digital currency system that’s decentralized. That means there are no central banks, there are no government agencies or even lawyers to defend you in the event of a dispute. It’s both a currency and a payment system: Users send a transaction to another user, who sends it back to you in bitcoin.

As such, Bitcoin is both a currency and a payment system. Just as gold and silver are physical commodities, so too are bitcoins. People can trade and sell bitcoins as they would any other commodity. But to store bitcoin, you’ll need a wallet software that lets you store your bitcoin in a digital form.

What makes bitcoin different?

Bitcoin is different in that it’s more than just a currency. Bitcoin is a virtual tool that allows you to transact with anyone in a decentralized manner. It also allows users to receive and send money and property without the need for a central authority. And while it works to execute the same transactions on your behalf, you won’t need to rely on a third party for identity, record-keeping, or accounting.

What is Bitcoin Mining?

Bitcoin mining is where miners collect transactions in a public ledger known as the blockchain. Miners perform this work in order to add new bitcoins to the network, which is like adding a new block to the chain. The rewards are allocated among them according to the current unit of the unit of the digital currency known as the satoshis, or unit of measurement. The higher the share of the total in mining, the more the reward; while smaller contributions get dropped.

How to obtain Bitcoin

Bitcoin exchanges and wallets vary greatly, but a few core factors likely apply. These include the amount of bitcoin required to send, trade or invest, the length of time until the next hard fork (or fork) and how much bitcoin you’d need to get.

First, use an exchange that offers a competitive exchange rate and active trading. Most exchanges allow you to withdraw funds when necessary. You can usually find bitcoin trading pairs that provide an effective price-to-volume trading strategy. Most exchanges offer prices in a range, with larger bourses often offering percentage-based support in lieu of cost-related decimal points.

Second, use a wallet that encrypts or scrambles your personal information. Use a service that operates in Bitcoin-friendly jurisdictions such as the Netherlands.

Third, use a wallet that supports multiple wallets, such as a Coinomi or Ledger Nano S. Although wallets differ on features and methodologies, each wallet comes with a unique multisig address and software required to spend from or back funds with it. Some wallets offer software updates to support specific features, while others have waited for the technology to mature. Some also encourage you to spend with coins directly, eliminating the need to transfer bitcoin to or from a third party.

By planning for these factors, you can protect yourself from the volatile nature of bitcoin trading and avoid costly transaction fees.