There are several ways to buy and sell Bitcoin, through a bitcoin exchange or through FX/CFD broker. There is the difference between Bitcoin exchange and FX/CFD broker and there is always question which one to choose. Buying a Bitcoin on a crypto exchange on Saturday is just as easy as during peak trading hours on a Wednesday, not every broker supports weekend trading. Secure exchanges that are trustworthy and have good user ratings will rank higher than their peers. There are hundreds of Bitcoin exchanges and their values of bitcoin are slightly different from one another. Some investors/traders trade with Bitcoin exchanges directly but most exchanges were not built for the beginners, their customer support is not always available, crypto exchanges have also fallen victim to cyber attacks. In the meantime, every forex and CFD broker seems to be offering Bitcoin trading. The major difference between brokers and Bitcoin exchanges is that with brokers you are actually trading a CFD(Contract For Difference), most of the time. On the Bitcoin exchanges, traders and investors can really buy Bitcoin. Trading on an exchange grants you ownership of the Bitcoin and you can transfer it to an address (your own wallet).

When choosing a broker or exchange, always check history and reviews to make sure their performance is consistent. Checking the reviews is something you should always do. Before choosing a broker, traders should eye broker spreads of their cryptocurrencies during several different trading periods.

The advantages of trading Bitcoin through FX/CFD brokers include:

- Better trading platforms

- Brokers are highly regulated

- Segregation of client accounts

- Usually better customer support

- Many years in business

- Leverage – FX/CFD brokers usually allow trading with leverage

- Brokers can provide a much higher leverage ratio

- Brokers usually accept deposit and withdrawal via Credit Card Debit Card, PayPal, Skrill, Neteller and bank transfer (easier to access for most people, when compared to most cryptocurrency exchanges)

- CFDs require an even lesser deposit, allowing traders to trade even more bitcoin and higher leverage to increase their profits even further

- Absolutely transparent and fair practices, technology to protect all data and secure methods for funds depositing/withdrawing

The disadvantages of trading Bitcoin through FX/CFD brokers include:

- With brokers, you are actually trading a CFD(Contract For Difference), most of the time

- Increased cost of trading, spread on bitcoin will be higher than spreads on Forex pairs

- Many brokers charge a commission on crypto trades

- There are also other charges such as those for holding trades overnight

- Due to volatility in bitcoins and other cryptos, brokers that are unhedged are more exposed to large losses caused by their client base

- Not every broker supports weekend trading – the FX, equity and futures market closes for the weekend, cryptos don’t

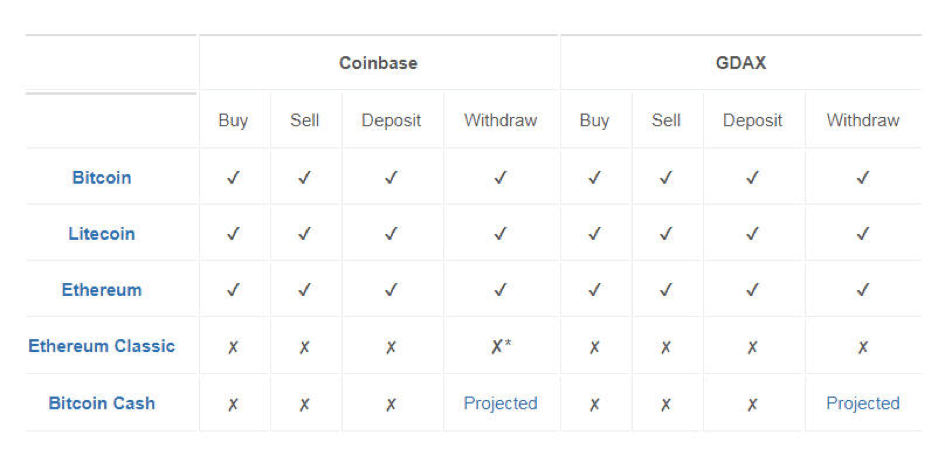

The advantages of trading Bitcoin through Bitcoin Exchanges

- When you buy Bitcoin, you can actually transfer it to an address

- Bitcoin exchanges support weekend trading

- Exchanges usually provide tighter spreads but apply a commission based on the volume of your transaction

The disadvantages of trading Bitcoin through Bitcoin Exchanges

- The security of your funds is not as high

- Some exchanges are not under direct regulation by any agency

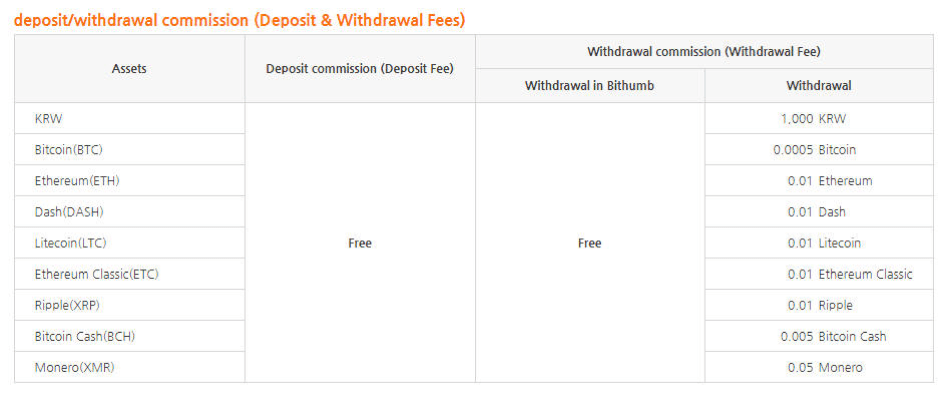

- Deposits and withdrawals are usually more complicated when compared to most brokers

- Customer support is not always available

- Exchanges usually offer average trading platform with several technical indicators available

- Crypto exchanges have also fallen victim to cyber attacks

- Only several years on the market

Conclusion

The major difference between brokers and Bitcoin exchanges is that with brokers you are actually trading a CFD(Contract For Difference), most of the time. On the Bitcoin exchanges, traders and investors can really buy Bitcoin. Trading on an exchange grants you ownership of the Bitcoin and you can transfer it to an address (your own wallet). Reputable brokers are highly regulated, on the other hand, some Bitcoin exchanges are not under direct regulation by any agency and security of clients funds is not as high. When it comes to the cost of trading, Bitcoin exchanges usually provide tighter spreads but apply a commission based on the volume of your transaction. Brokers usually include all the costs in the spread. When choosing a broker or exchange, always check history and reviews to make sure their performance is consistent. Traders can find lots of useful information and reviews on the internet. The Internet also makes it very easy for people to post their experiences and useful information. A few key points that are also very important include regulation, customer service, platform type and reputation. I would rather choose a secure a friendly broker that offers many tools for its customers with a good reputation and 24/7 customer service.

What you should know about Bitcoin

Is Bitcoin safe?

Bitcoin is a very safe way to pay because no one knows what your wallet does. Unlike traditional banks that risk exposing their customers to fraud or financial loss, every Bitcoin user is directly connected to the Bitcoin network, and has full, unreviewable visibility into the numbers behind all of its transactions.

You can use bitcoin in two ways: either to purchase goods and services, or to donate to a charity. Before bitcoin was integrated into the payments ecosystem, merchants had to accept a credit or debit card for transactions, so bitcoin payments generally aren’t direct.

Many people use bitcoin to send money internationally. There are four main methods for sending money using bitcoin:

Hotels – Bitcoin payments are accepted in some 100,000 hotels in nearly every country in the world. Check out the full list of bitcoin-accepted hotels in your country.

- Bitcoin payments are accepted in some 100,000 hotels in nearly every country in the world. Check out the full list of bitcoin-accepted hotels in your country. Third-party payment processors – Many major retailers accept bitcoin payments, and many more are likely to follow suit.

- Many major retailers accept bitcoin payments, and many more are likely to follow suit. Transfer services – Most exchanges accept bitcoin payments.

- Most exchanges accept bitcoin payments. Local sellers – Sellers of all types, from homebrew to casino operators, sell bitcoin in the local market.

How do you buy Bitcoins?

There are two main ways to buy Bitcoins. The first is through a third-party brokerage, where you and the company you choose will handle all of the transactions for you. Typically, this involves you personally making the final payment, meaning you send the money to the bitcoin address that belongs to the brokerage you use.

Another option is to buy bitcoins directly from a person or company that accepts credit or debit cards or PayPal. To use these options, you’ll need to sign up with your bank, credit card company, or PayPal account, and then send the bitcoins to the address listed in your account.

In both of these cases, the broker or merchant is required to keep the majority of the fee.

What are the advantages of buying Bitcoins with credit cards?

On its face, using a credit card lets you send coins to your broker or merchant. If you have a small balance on your card, you can buy just a small amount at a time, sending small amounts to different accounts. There’s no minimum amount of bitcoins you can buy, which makes it much more convenient to use.

The problem, of course, is that a credit card is often linked to other cards, so the risk of your broker or merchant freezing your account is high. After all, you could lose your money if your broker doesn’t start taking incoming credit card payments immediately. Also, unless you have a special coupon or code that gives you a slight advantage, getting your card declined is one of the worst situations.

Why don’t you just use PayPal?

There are a few reasons you might not choose to use PayPal or a credit card. First of all, while it can take several days for your deposit to appear in your PayPal account, the transaction can usually be completed within hours. You also may find that using a credit card or debit card offers more flexibility, as your payee usually charges only the credit card or debit card or bank account you use, rather than the actual dollar value. (Here’s more info about setting up a payment card.)

Another factor: Some merchant payment processors (credit cards, PayPal, etc.) may check to see whether or not your credit or debit card is associated with your account before transferring any bitcoins. Since you’re using a third party to send bitcoins, this might be suspicious, and the company that processes transactions (possibly PayPal, but often not) may refuse to process a transaction if it finds that you don’t have a credit or debit card or debit card tied to your account.

Ethereum FAQ

What is Ethereum?

Let’s begin with a simple definition and exploration of what Ethereum is.

Ethereum is essentially a kind of social network that acts as a decentralized backend for many different blockchain applications.

What does it do?

What do you get for helping run the Ethereum network?

It gives you mining rewards. They are actually called ether, but they are also called ethereum. They are the means by which other people will validate your transactions on the network.

You also get a reservation for your own private blockchain. For example, it can be the private blockchain of anybody, a computer or another Ethereum application. And if they want to run it, they must pay for the reservation.

Some applications have an operating fee associated with it, too, like running a trading app.

You also get access to other computing resources on the network, like CPU or GPUs that other people can run on their machines. More technical details can be found on Wikipedia

But what are those resources? Most of them are available for everyone to use, provided they pay a fee to host a node on their machine.

Now you can run some applications that you couldn’t before, like 3D games, gaming apps, internet of things and so on. It’s easy to get started, there are no complex requirements.

This is great, right? So you can run a blockchain game without any software. But what if there was one you wanted to run, and there was no node in the world that was willing to host it?

There are services like rLoop that take you through a registration process, which you have to do online. You also pay a fee to hosts. Revenue is also generated by the hosting services.

You have to pay these fees just to run a block. They don’t give you anything. So you can’t host any kind of Ethereum application, because you can’t run any applications on them.

Dozens of virtual private networks exist, some less restrictive. I like Cura, which you can connect to for free. You can also have your own private network called Mercurial, but it has a bit of a weird setup. They have a lot of limits on your running times, when you can run your application.

You also have to pay for a mining lease. The lease ends when the blockchain runs out of gas. You pay the price, and the network runs out of gas in turn. And it gets cheaper the more you pay. So I think it’s a bit of a pain, but it happens, so don’t get overly worried if you are stuck waiting for a block to confirm. It will come eventually.