Trading is an active style of participating in the financial markets in which traders seek short-term price moves in order to profit instead of waiting to profit from long-term price movements. It is relatively easy to start trading but it is very difficult to become good at it and to become the profitable trader.

Becoming a profitable trader requires a strategic plan with short and long-term goals, what you will trade, the amount of capital, trading time frames. A good trading plan must be researched, tested on historical data and tested in a live market. Potential traders should plan on devoting a substantial amount of time and effort before ever placing a trade in a live market. Traders beginners should open a demo account, try to become profitable and continue to evaluate at regular intervals before funding the account or placing trades. The profitable traders use a combination of technical and fundamental analysis to make trading decisions. Technical analysis attempt to predict the future price movement by analyzing statistics and charts gathered from trading activity, such as price movement and volume. They apply technical indicators to charts of various time frames in attempts to accurately forecast future price movements (support and resistance, moving averages, chart patterns, trendlines).

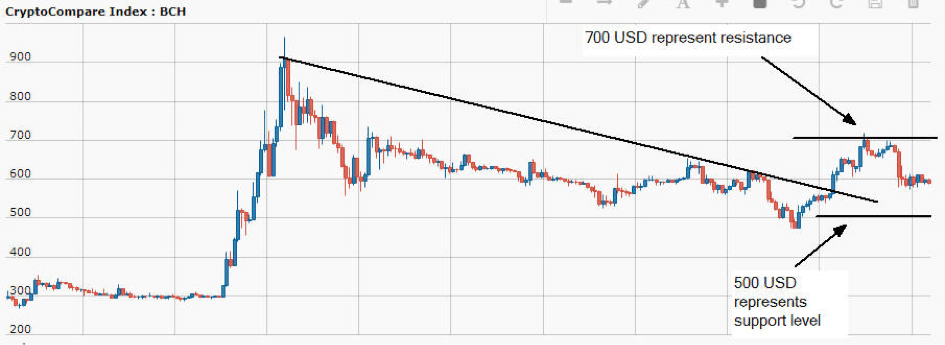

The example of technical analysis (Bitcoin Cash on 09.09.2018, the price was $587)

- On this chart, I marked resistance and support levels. Support level is 500 USD, 600 and 700 USD represent resistance levels. The price has broken the line on this chart and started to grow, 700 USD target was reached and after that price has started to fall (now is again below 600 USD). If the price jumps above 600 USD it would be “BUY” signal and we have the open way to 700 USD and then 900 USD. Rising above 600 USD level (psychological resistance) is important to achieve the waited targets, this supports the continuation of bullish trend overview efficiently for the upcoming period. According to Elliott wave theory, this could be the beginning of the wave 3 (This is usually the longest and strongest wave). If the price jumps above 600 USD that could be a very good opportunity for the short term traders, short-term traders can put the stop loss at 590 USD and take profit at 650 or 700.

- Recommendation: If the price jumps above 600 USD that could be a very good opportunity for the short term traders, short-term traders can put the stop loss at 590 USD and take profit at 650 or 700. If the price drops below 530 it has an open way to 500 USD, if the price drops below 500 USD support that would be a strong “SELL” signal and the open way to 400 USD.

Fundamental investors are keen to evaluate key aspects of the cryptocurrency’s underlying technology. When doing an analysis for trading a cryptocurrency on a fundamental basis several things should be considered: the characteristics of the coin, how active is development, how active is the community, transaction activity. According to analysts interest for cryptocurrencies will continue to grow and the value of individual coins will increase in the second half of 2017 and in the 2018 year. Many currently used coins have limited support, outside of major crypto-exchanges. It can be very difficult to figure out what coins to add to your portfolio. It is important to do a lot of research and try to identify those currencies which are likely to fit together in an overall ecosystem, rather than trying to pick a single winner.

Styles of trading

There are four main styles of trading: scalping, day trading, swing trading, and position trading. Choosing the trading style that best suits your personality can be a difficult task, but is absolutely necessary to your long-term success as a profitable trader.

- Scalp Trading – traders target the smallest intraday price movements and rely on frequent and very small gains to build profits

- Day Trading – positions are entered and exited on the same day, trades are closed by the end of the trading session

- Swing Trading – positions are held for a period of days or weeks in an attempt to capture short-term market moves

- Position Trading (trading with the longest trading time frame) – positions are held for a period of months to years. Position traders may utilize both long and short trading strategies and this style is very similar to investing

Summary

Trading is an active style of participating in the financial markets in which traders seek short-term price moves in order to profit instead of waiting to profit from long-term price movements. Becoming a profitable trader requires a strategic plan with short and long-term goals, what you will trade, the amount of capital, trading time frames. Traders beginners should open a demo account, try to become profitable and continue to evaluate at regular intervals before funding the account or placing trades. One of the biggest mistakes that new traders often make is to change trading styles at the first sign of trouble. The trading style that suits you best includes a variety of factors like personality, risk tolerance, level of trading experience, account size, amount of time that can be dedicated to trading. My recommendation for the new traders is once you are comfortable with a particular trading style, remain faithful to that trading style and always use “stop loss” and “take profit” orders.

How does Bitcoin work?

Bitcoin is a digital currency that’s also called a cryptocurrency. Technically speaking, a cryptocurrency is a digital currency that is different from cash or a credit card. They are quite different because while a bank has physical and digital banking devices that you can use, a cryptocurrency or token has no physical form and can be sent without a bank account or a central authority. Instead, you own, hold or use the cryptocurrency directly, without leaving your bank account or using a third party service provider.

Bitcoin is similar to cash because it works on a very similar principle to what a bank does: storing value in a digital form and transacting. However, unlike cash, a cryptocurrency is a limited and accountable medium of exchange. Anybody with a computer or smartphone can make and redeem transactions to and from you.

You can use a Bitcoin wallet on your computer or mobile phone to view the history of your own transactions or to participate in the system, either for the purpose of withdrawing or verifying the identity of someone else, or to request additional payment.

Making a cryptocurrency exchange

As of April 2018, Bitcoin has arrived at the stage where it can be accepted as a legitimate currency for retail purchases. There are many services that are supporting this process, including Localbitcoins.co.uk, Luno and Coinmechanical. The full list of trading pairs and services is on the Service Legal Guide.

The Bitcoin principles

Bitcoin is working to keep Bitcoin users secure and honest. “The Bitcoin protocol is designed to ensure that once a transaction is confirmed on a public ledger, the originating computer node and all associated information is hidden from public view,” the company explains. “Bitcoin is a public ledger, meaning that all of the history of every Bitcoin transaction is accessible to the public, including copies of the transactions. Users can download this history from the blockchain and check it for themselves.”

How does Bitcoin Mining work?

To obtain Bitcoins, people exchange tokens representing Bitcoins—or units of those tokens—with each other. This process, called Bitcoin mining, is used to verify that the transaction is valid. There are currently two major mining pools: one pools such as GHash, the second is centrares like AntPool. Over time, as miners optimize their systems, they accumulate a record of the number of times transactions were verified.

Bitcoin miners are incentivized to earn a share of this reward, and they do so by agreeing to pay fees to other miners who compete for them. This market forces miners to adopt new methods to be profitable.

The blockchain contains the complete history of all confirmed transactions, as verified by miners. It stores a huge amount of information on Bitcoin transactions, including their origin, timestamping, block height, and transactions’ inputs, outputs, and fees. For added security, Bitcoin miners also keep the order of these transactions. By doing so, they avoid interference from previous miners.

How is it made secure?

Now that you know how miners make Bitcoin secure, let’s take a closer look at why there is so much hashing power involved in the process.