According to analysts interest for cryptocurrencies will continue to grow and the value of individual coins will increase in the next years. Furthermore, the political atmosphere is going to have a major impact on how cryptocurrencies fair in the long term. A rapid growth in any of the crypto-currencies and assets such as Bitcoin, Ether, Zcash, Ripple, and others, many will call it out as a bubble. The combined market capitalization of all public cryptocurrencies has surged in last six months, the total market cap of so-called ‘altcoins’, cryptographic tokens that seek to serve alternative use cases to bitcoin, has surged more than 700% from early March. According to some analysts, cryptocurrency market is currently overpriced, so many cryptocurrencies – including those that haven’t seen technical or business progress – have risen in value. Some analysts are more optimistic, asserting that cryptocurrency prices have significant room to appreciate and according to them the price hikes in last several years/months are not the sign of a bubble. Positive thing is that crypto-currency market is now attracting the attention of major banks, businesses and governments, all interested in the potential of the technology to provide greater efficiency and transparency in transactions. My opinion is that this is a highly speculative market but it has big potential. A new ATH (all time high) is extremely likely, with continued demand for bitcoin and cryptocurrencies worldwide. There is a correlation between the price movements of bitcoin and other cryptocurrencies and crypto assets. As long the bitcoin is above 3000 USD cryptocurrency market is generally in the “BUY” zone. Cryptocurrencies, as a whole, now hold around $130 billion in market cap and if the price of Bitcoin advances more, it would certainly have a positive impact on other cryptocurrencies (BTC has a market cap at just over $65 billion).

Many currently used coins have limited support, outside of major crypto-exchanges. It can be very difficult to figure out what coins to add to your portfolio. It is important to do a lot of research and try to identify those currencies which are likely to fit together in an overall ecosystem, rather than trying to pick a single winner. Because all of this, I would recommend everybody to be careful and to invest a small sum of money in cryptocurrencies (a sum of money that you are able to “risk”, for me that is several hundred USD). The best time period for me is between 3-5 years, hold and wait.

The examples of good coins for trading and investing

Cryptocurrencies are trending all over the world as the internet payments have been accepted by many companies. Bitcoin continues to claim about 47% of the total market cap, while ethereum’s share is around 20%. A number of reasons have pushed bitcoin to record highs, such as legalization of the currency in Japan for payments, boosted interest from Korea, as well as the conclusion of a debate about the future of the cryptocurrency.

Some other cryptocurrencies with a high volatility that could be a good opportunity for investors and traders are: Bitcoin Cash, Ripple, Litecoin, Dash, Monero, NEO, Basic Attention Token.. When doing an analysis for trading a cryptocurrency on a fundamental basis several things should be considered: the characteristics of the coin, how active is development, how active is the community, transaction activity.

The main characteristics that you must consider before buying or investing in cryptocurrencies:

- Market capitalization and daily trading volume – I would always try to avoid cryptocurrency with small market capitalization and cryptocurrency with low trading volume

- Retailer acceptance – some of the popular cryptocurrencies are widely accepted just like Bitcoin

- Verification method

- Characteristics of the coin

My opinion is that Ripple, Monero, Litecoin, Lisk, Dash and Ethereum could be a very good opportunity, Ripple is my favorite. Increasing numbers of institutions use the Ripple protocol. Last year, Ripple partnered with a Japanese consortium of banks to create a payment network. In September 2016, Ripple announced another interbank group, the Global Payments Steering Group, for global payments. It includes Bank of America, Merrill Lynch and other big names. More recently, in April 2017, Ripple announced that ten additional financial institutions have joined their network. Ripple partners include the likes of CIBC, Deloitte, Earthport, Mizuho, Santander and Standard Chartered. The Ripple protocol has been increasingly adopted by banks and payment networks as settlement infrastructure technology, it’s system has a number of advantages over other cryptocurrencies, that’s why it’s being used by companies such as UniCredit, UBS & Santander. So the digital coin looks to have a bright future as it will be implemented in the financial system and despite its current low price it can catch up the move to the upside really quickly.

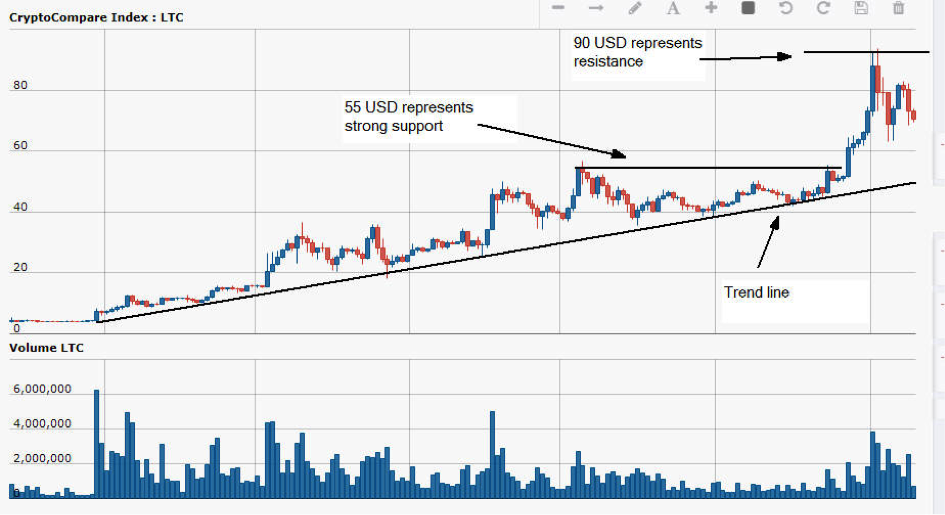

The example for the short-term traders who trade with “stop loss” and “take profit” orders, Litecoin = $ 71.10

- The price of LTC has made a very big jump in one month period (from $41 above $90). When we take look at this 6 months chart we can see that major trend is “bullish” (uptrend). As long the price is above this trend line there is no indication of the long trend reversal and LTC is in the BUY zone (Big Investors are still in the long – BUY position on this crypto). Support level is 55 USD, the resistance level is 90 USD. Rising above 80 USD we have the open way to 90 and then 100 USD. If the price drops below 70 we have the open way to 55 USD support.

- Recommendation: If the price drops below 70 we have the open way to 55 USD support and this could be a good entry point. Rising above 80 USD we have the open way to 90 and then 100 USD. Short term traders should always use “stop-loss” and “take profit” orders when they are opening their positions (the risk is extremely high).

How to avoid selecting scam coins?

In the Blockchain space, crowdfunding has become extremely popular. There are now multiple platforms where users can crowdfund their projects into reality, this projects usually occur in the form of ICOs (Initial Coin Offering). The initial coin offerings are speculative like building a new city, the infrastructure needs to be developed first before you get to see who moves there. Nobody can’t tell for sure if a certain project is worth investing in or not and I would recommend everybody to never invest more than what you can afford to lose. Even honest projects can be a complete failure, here are some examples how to avoid selecting scam coins:

- Scam projects will often make bold claims about their product

- If someone claims their cryptocurrency will replace Bitcoin, get millions of users, or increase by 100x in the price charts, you can add that project to the scam list

- If the project provides no link to the code, then it’s not worth your time nor money

- Check the type of escrow, this one is extremely important. Escrow is basically a service that holds coins for their customers until a certain deal is completed

- Who is behind the project, this is very important information. The team who is made up of well-known members of the cryptocurrency community is always a better opportunity. The most serious projects often have at least one known face in their team

- Remember to check all social profiles of some team, when the account was created

- You can also easily check if they are a real member of the Bitcoin community through a very handy feature on Bitcointalk

- Scammers will rarely try to fake pictures

- I would always try to avoid cryptocurrency with small market capitalization and cryptocurrency with low trading volume

Many currently used coins have limited support, outside of major crypto-exchanges. It can be very difficult to figure out what coins to add to your portfolio. It is important to do a lot of research and try to identify those currencies which are likely to fit together in an overall ecosystem, rather than trying to pick a single winner.

Things you should know about Ethereum

Where to buy Ether

In order to buy Ether you must be signed up with a cryptocurrency exchange or purchase them through an exchange. Most of the cryptocurrency exchanges out there are based in the United States and have terms of service that make it fairly easy to buy, sell or send ether. The easiest way to buy ether is through Coinbase.com. You do not need an account or to have any other money to purchase ether. You simply need an ethereum address (a long string of 16 or 32 characters).

For every transaction of ether, there is a transfer of ether back to the sender of the transaction. These ether transfers are called ether dividends.

Dividends are effectively a form of debt or equity where the issuer of the ether reserves the right to sell the ether back to the purchaser at a discounted price. This special lending operation happens multiple times a day, usually at a discount to market value. The purchaser may have to pay a small percentage of the purchase price, usually around 0.1 percent. The funds are used to buy ether back to your account.

If you are buying ether in a transaction that takes place via a exchange, the transaction will typically include a small amount of ether that is used to purchase a small amount of ether from the exchange. This is called the purchase price.

Understanding Ethereum for Microtransactions

One of the biggest concerns facing decentralized applications are the scaling challenges of a system that needs to keep up with the millions of transactions that are processed by the network each second. This is one of the main factors that may affect the cost of buying a good or an exchange or if you can use your electricity bill to pay for a subscription. This can be mitigated by using specialized protocols that cut transaction processing time in half, but they cost many thousands of dollars and must be managed with huge amounts of specialized hardware. On the other side of the equation, there are other ways to raise funds. These are known as ICOs (Initial Coin Offerings), and they are the most common way to raise funds for developing or launching an application.

Why are they useful for applications?

One of the biggest advantages of ICOs is that they offer to crowdfund a solution for a problem that is beyond their current market ability to solve. A crowdfunding model also often offers rewards to participants who help others solve problems and get their work done faster. This is because crowdfunding platforms have the financial resources to go through all the verification needed to launch the project, which is normally a lot more expensive than launching in the open market. This also offers investors, including those in the traditional financial world, a better return on investment (ROI) and a way to get involved.

With Ethereum, there is a whole new type of approach that can be used for crowdfunding applications:

Supply Chain: The Namecoin Movement

Supply chain projects aim to get involved in the development of a specific and useful technology that is not already widespread. Projects that use blockchain technology might include protocols that help make real-time transactions faster or store identities. As of now, there are many projects using namecoin technology, and the name we’re talking about here is no other than Dogecoin, the internet meme that started as an ironic joke but later became a meme of its own.

Blockchain For A Social Network

Another important project that uses the Ethereum blockchain is Kiku, an open-source messaging platform that sends out private messages in seconds. Another project that uses the blockchain for its first version of a social network is Zello. This is because the project has created its own virtual ether, “vibration ether,” to use for marketing and advertising purposes.