Shorting a coin is basically betting against the coin, when you buy a coin then you are expecting for the price to go up and that is the way you make profit, but when you short a coin you are expecting for the price to go down instead of up that way you can make money when the price goes to the opposite direction and for those with great skill is a way to make some good money. The most of the cryptocurrencies speculation occurs through long and short positions across trading platforms. The easiest way to go short on different coins is to sell cryptocurrency at a price you feel comfortable at, wait until the price drops, and buy that cryptocurrency again. It is also very important to find the right broker or exchange that offer margin trading and have great liquidity. There are only a handful of exchanges that allow shorting and have good liquidity. The major difference between brokers and cryptocurrency exchanges is that with brokers you are actually trading a CFD(Contract For Difference), most of the time. On the cryptocurrency exchanges, traders and investors can really buy cryptocurrencies. Trading on an exchange grants you ownership of the coin and you can transfer it to an address (your own wallet).

There are various different ways that traders can ‘go short’ and one of the most common ways is by using a cryptocurrency margin trading platform. Traders/investors have to join a platform that allows margin trading and deposit some bitcoin or whatever coin they want to short into their account as collateral. Traders should keep in mind that margin trading can generate much larger losses than traditional trading. It’s not a good idea to hold a short position for long periods of time or to leave an open short position with no stop-loss order. Below is a brief list of ways to short cryptocurrencies (this can be applied to different coins):

- Traders can sell cryptocurrencies in the hope of buying them back later at a cheaper price (the easiest way). Although this is how most “traditional” traders make money, it is an efficient way of shorting cryptocurrencies.

- Futures contracts – this contract is a very good way to short cryptocurrencies. This contract allows buying a cryptocurrency at a future date and a fixed price. The trader buying a futures contract thinks the price for example, per Bitcoin, will go up and he will be able to purchase Bitcoin below the market price when the contract “expires”.

- Options contracts – traders can place a bet that the value of some cryptocurrency will be lower than a particular value at a certain point in the future (for example 1 day, or 1 week). A fall in cryptocurrency value will earn a profit, which is exactly what shorting is all about

- Binary options – traders can place a bet that the value of some cryptocurrency will be lower, usually measured in hours with the end of that day. Traders looking to short some cryptocurrency would execute a PUT order. If the price at the expiration time is lower than the original price, you earn the option’s payout. This is trading with a very high risk because you will lose everything if you are incorrect.

The example of shorting a Bitcoin

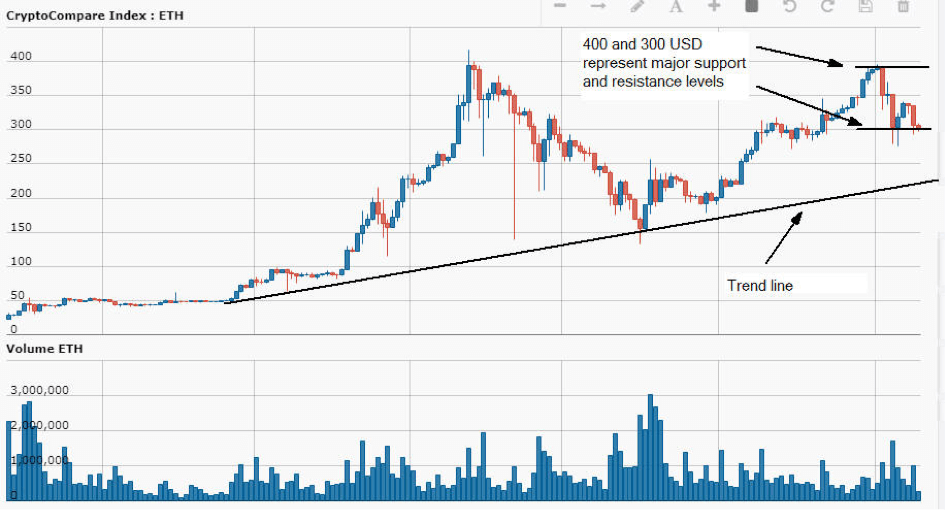

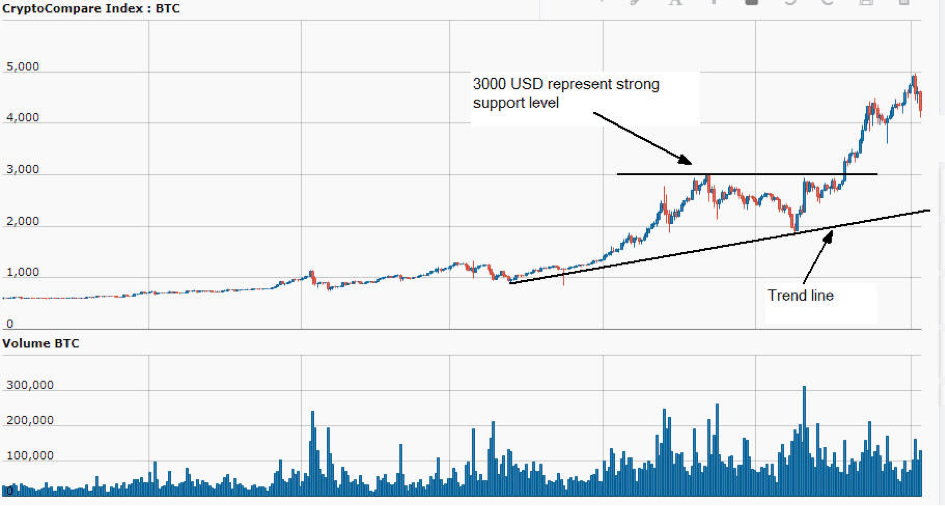

BTC has made a very big jump in the small time period and according to Elliott wave theory, this could be the beginning of the wave 4 ( corrective phase). A number of reasons have pushed Bitcoin to record highs, such as legalization of the currency in Japan for payments, boosted interest from Korea, as well as the conclusion of a debate about the future of the cryptocurrency. The price of Bitcoin on 04.09.2017 was $4,316 and my opinion was that this coin was overpriced and I sold it. The easiest way to go short on different coins is to sell cryptocurrency at a price you feel comfortable at, wait until the price drops, and buy that cryptocurrency again. When we take look at this 12 months chart we can see that major trend is “bullish” (uptrend). As long the price is above this trend line there is no indication of the long trend reversal and BTC is in the BUY zone (Big Investors are still in the long – BUY position on this crypto).

Recommendation: If the price falls at $3000, this could be a good position for the traders ( stop loss at $2900 and take profit at $3500). Traders can sell cryptocurrencies in the hope of buying them back later at a cheaper price. Buy low and sell high is the most efficient way to publicly short Bitcoin and try to persuade other traders to do so as well.

What is Bitcoin all about?

A Bitcoin (also called a “satoshi”) is a type of computer code that is stored on a computer chip. The maximum number of units of a Bitcoin is 21 million, but that limit is widely adjusted. If people were to use Bitcoin as money, each unit of Bitcoin would be worth about $130,000.

A Bitcoin is created when a computer program or group of software code is submitted to a peer-to-peer network. This process is similar to a cryptographic hash function, which allows computer programs to verify the data stored on the computer and identify whether or not it was created by a person or a group of people.

Buying Bitcoin is a lot like any other stock investment, which is why it’s so very different from investing in stocks. There are a few important things to keep in mind while considering buying Bitcoin.

Is Bitcoin a good investment?

Buying Bitcoin and trading it is still an extremely risky investment. While the price of Bitcoin and other digital currencies may fluctuate a bit depending on the market, it is not uncommon for it to drop drastically in value and trade in a public market. In general, large, systemic investors that use advanced hedging strategies are betting against cryptocurrency price crashes and becoming billionaires. Investors should take such long-term profits with caution.

To take full advantage of crypto investments, it is recommended that investors hold on to Bitcoin in case any future shocks hit the markets or cryptocurrencies lose value. Once cryptocurrencies have recovered, they’ll almost certainly appreciate in value again.

Investing in cryptocurrency is great if you want to diversify your portfolio or diversify your return. By holding bitcoins in a Bitcoin ETF and allowing it to earn the full amount of its market value over time, you are effectively becoming a market maker, which should provide an added level of safety and help protect your Bitcoin investment.

Is Bitcoin secure?

Bitcoin works because it uses a public, distributed ledger to verify all transactions. This makes it impossible for any single party to control or edit the ledger.

In theory, if some entity gets control of Bitcoin, it could change the ledger. Even if no entity could manipulate the blockchain, it could take legitimate transactions offline.

This risk is greater than Bitcoin users might realize. For instance, Bitcoin is part of the global financial system, and any one person or organization with the technology to do so could cause widespread financial disruption.

What do other money systems look like?

Bitcoin shares many qualities with traditional money. Like checks and cash, it is highly secure, traceable, and allows a constant stream of transactions. However, there are some important differences. First, there are virtual currencies such as Bitcoin Cash and Litecoin. Second, most traditional money systems only allow you to use one currency or another, while Bitcoin allows you to use both different coins. While most banks use paper currency, many do not yet accept Bitcoin, but you can exchange with companies that do.

How to buy Bitcoin

If you want to buy Bitcoin, you can make a transaction in bitcoin or find another cryptocurrency that has run a bitcoin.

To buy bitcoin or find another cryptocurrency, you can use the Bitcoin Wallet, the official app for the Bitcoin network.

Once you have a Bitcoin Wallet, you can send bitcoin to your recipient.

To send bitcoin, click on the “Send” button and enter the number associated with your Bitcoin Wallet. To send bitcoin to a different address, click on the “Change” button and enter the new address.

You can send bitcoin to any Bitcoin address by clicking on the “Send” button.

When you receive bitcoin, click on the “Receive” button to view the amount of bitcoin that’s in your wallet. Click on “Withdraw” to transfer bitcoin from the address you created in the “Withdraw” tab.